Best London Will Writers With Roger Bourdon

Best London Will Writers (commonly know as Enfield Wills) is owned and managed by Roger Bourdon who is a highly specialist will writer in London UK.

If you're looking to get a will written in London, and you need to speak to a professional will writer, then you should talk to Roger Bourdon and his team at Best London Will Writers.

Look no further than Best London Will Writers, led by the expert Roger Bourdon, if you're looking to start writing your will but don't know where to begin.

Specialising in London Will Writing Services and with over 20 years of experience in estate planning, Roger is a top-tier professional in will writing, and can assist you in creating a legally binding document that ensures your loved ones are taken care of after you pass.

At Best London Will Writers, our personalised service takes the stress out of will writing, making the process as smooth and straightforward as possible. Our team works with you to understand your unique circumstances and create a will that reflects your wishes and safeguards your assets.

Roger Bourdon, a member of the Society of Will Writers and regulated by the Institute of Professional Will Writers, is at the helm of Best London Will Writers.

He has extensive training and experience in all areas of will writing and complies with UK law, giving you peace of mind.

Don't wait any longer to begin securing your loved ones' future, as it is extremely important as you realise.

Phone Roger Bourdon now to discover more about our personalised will writing service and how we can assist you.

Get Your Will Written Before It's Way Too Late

Everyone realises they need to have a will written for themselves and their loved ones, but sadly many people leave it till it's too late. Don't procrastinate when it comes to getting a professional will written for yourself and your family.

Talk to Roger Bourdon and his team at Best London Will Writers today, to give yourself and your family the benefits of being able to produce a legal will in times of hardship.

We have been writing Wills, Lasting Power of Attorney, Trusts and allied services for over 12 years. We work with a team of Independent Financial Advisers within the company who we call on to support and make recommendations on people’s financial circumstances. Between the team and I, we provide a complete holistic solution for you. We see clients in their own home or meet in our office in the city of London.

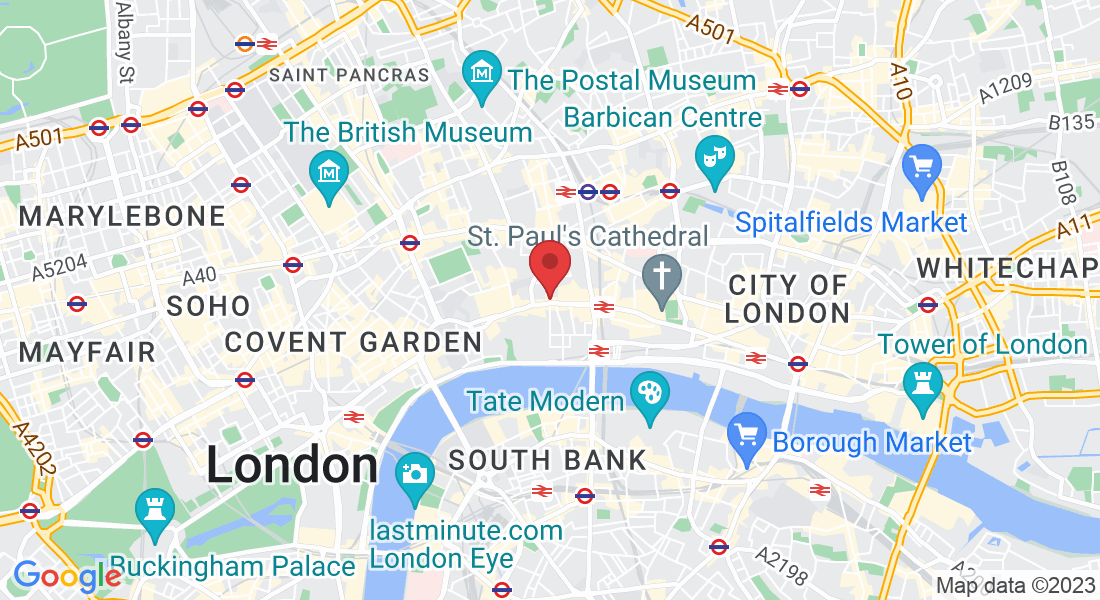

Our Fleet Street Office

If you'd like to schedule a meet up with Roger Bourdon at our Fleet Street Office in London, let us know right now.

London Will Writers

We have a break out area in our office for you to relax and unwind, while having a pleasant chat to our team.

Guaranteed Success

When we write a will for our clients, we write it like we'd be writing it for one of our family. We care for you at all times.

We Triple Check

Once your will is written, we have our team triple check everything, to make sure it's exactly the way you want it.

SEE WHAT WE DO

Best London Will Writers Services

Single & Joint Wills

Unless you make a will, your estate may not pass to the people you want it to. Should you pass away without one, the law decides how your assets are distributed. People who die without a will (or ‘intestate’ as it is known) can leave their families with complex financial affairs to deal that can take months to sort out

Living Wills

A Living Will is a legally binding option for people wishing to retain control over future medical conditions. It usually gives specific details about medical treatment and life-sustaining treatment. A Living Will can only be made by someone who mentally capable of making such decisions

Lasting Power Of Attorney

If you lose the capacity to take decisions for your self, no one else can, including your spouse. unless there is a Lasting Power of Attorney in place. Without it, your spouse will need to apply for permission to take these decisions causing unnecessary delay and can costing thousands.

Inheritance Tax

Inheritance Tax (IHT) is a tax on the estate of someone who’s died. Their estate is defined as the total value of their assets less the total value of their liabilities. After deducting their tax free allowances any remaining amount is taxed at 40%. However, there are ways to mitigate and reduce your IHT liability.

Funeral Plans

The cost of a complete funeral is significantly outstripping inflation often leaving bereaved relatives unable to pay for a funeral for more than a year or needing to borrow from friends and family. Not surprisingly over half a million people in the UK have taken out some form of funeral plan, which caps the price of a funeral at today's prices.

Probate & Estate

Estate administration is the process of dealing with a person’s legal and tax affairs after they’ve died. This means dealing with all their assets (such as property, shares and personal possessions), paying debts and paying any Inheritance Tax and Income Tax. Whatever's left is transferred to beneficiaries.

Get In Touch

Email: [email protected]

Address

City & Country Financial Services Ltd

154-160 Fleet Street, London, EC4A 2DQ

Assistance Hours

Mon – Fri 9:00am – 5:00pm

Weekend – CLOSED

Phone Number: